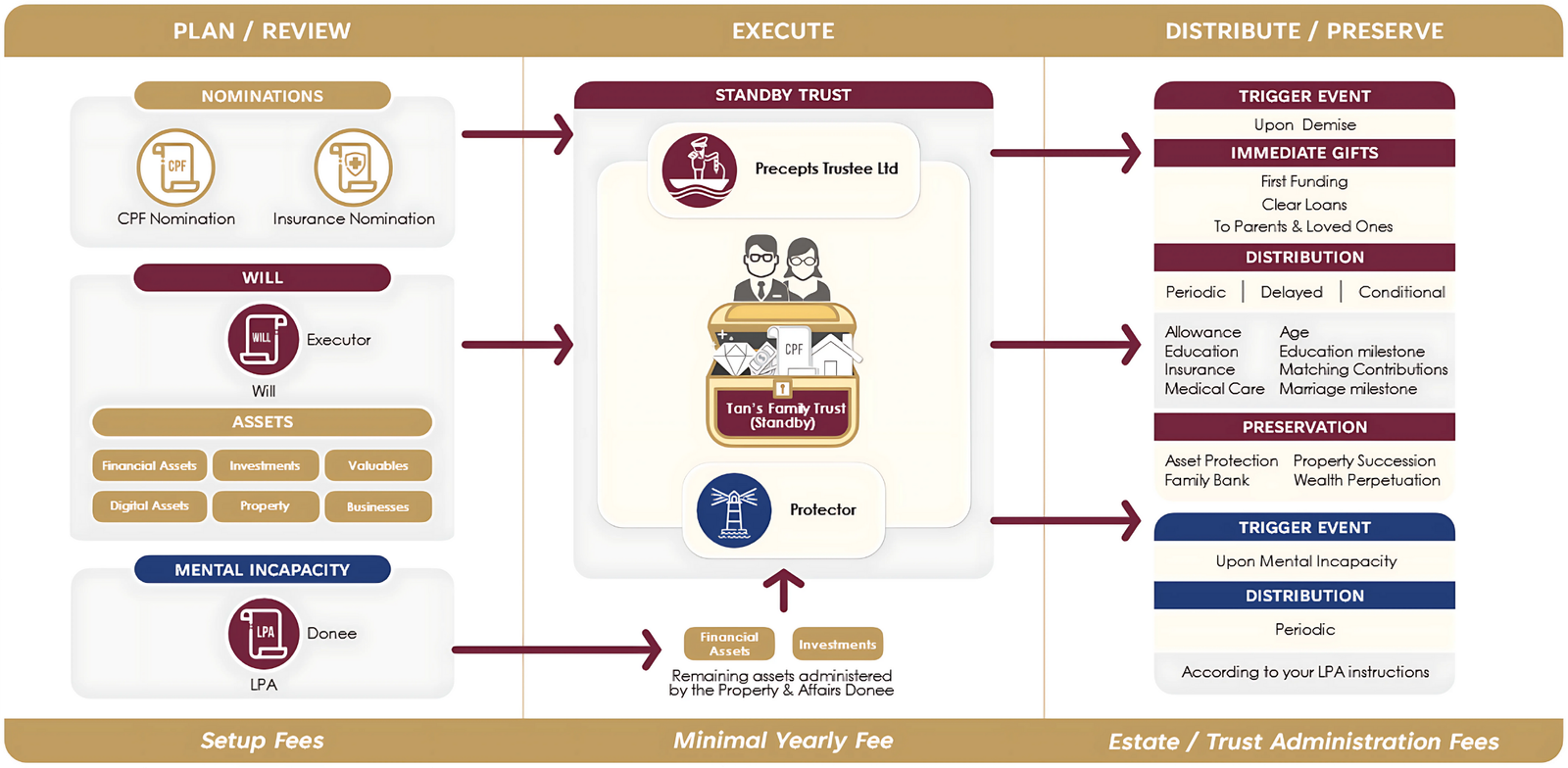

Standby Trust

Protect your legacy by setting up a Standby Trust—an arrangement that ensures your assets are safeguarded and managed according to your wishes in the event of incapacity or death.

Secure Your Future with a Standby Trust

In life, we all hope to chart a smooth journey toward peace of mind for ourselves and our loved ones. But when uncertainty strikes—illness, incapacity, or loss—it can shake the stability of even the best-laid plans.

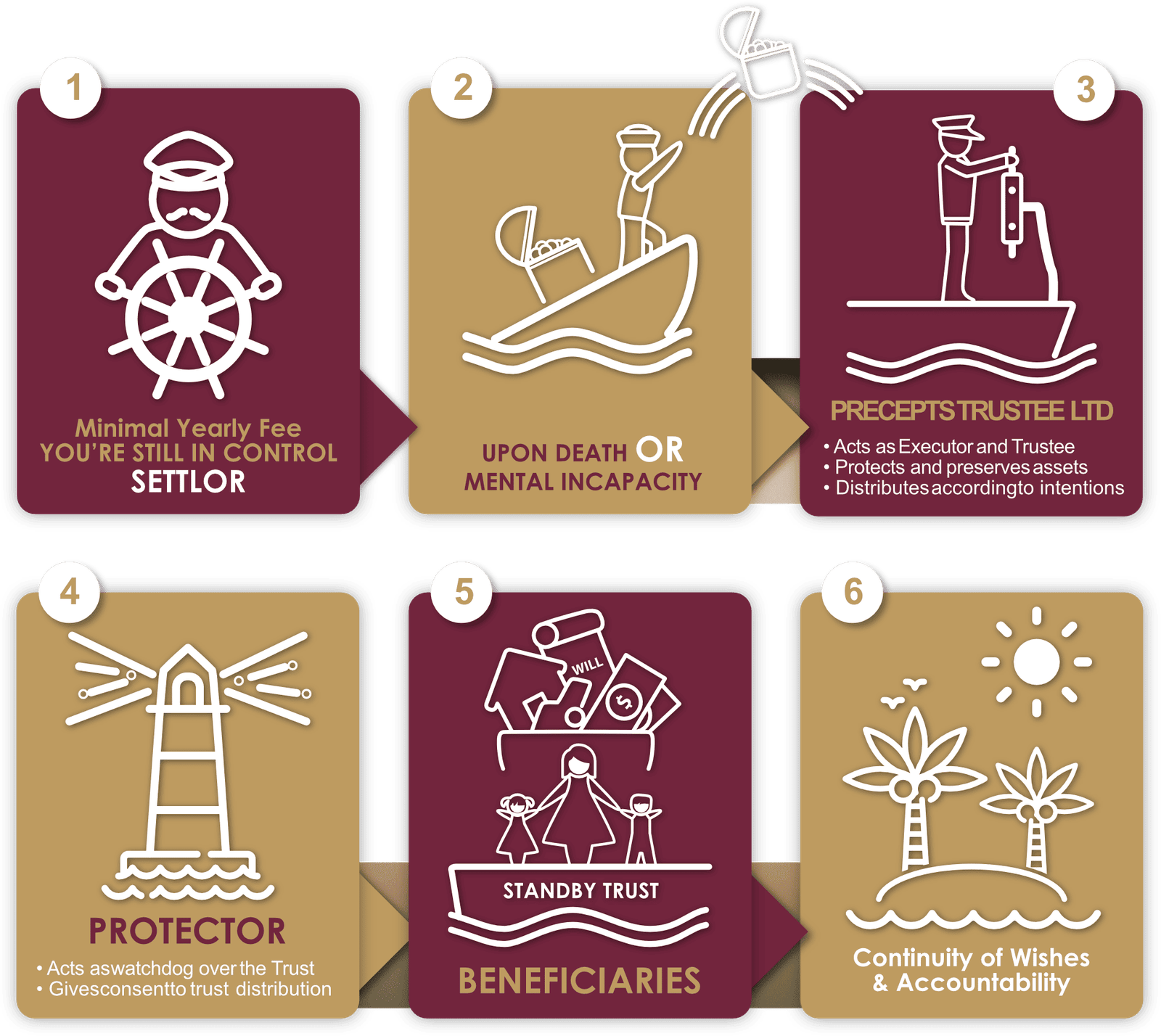

That’s where a Standby Trust comes in. It acts like a compass—guiding your loved ones according to the directions you’ve already set. With your instructions clearly outlined, assets can be held and safeguarded in advance, ready to activate when needed—such as during mental incapacity or life transitions.

With a Standby Trust, you stay in control—giving your family direction, comfort, and certainty when they need it most.

Let your loved ones focus on healing—not paperwork.

Benefits of a Standby Trust

Creating a Standby Trust isn’t just about asset protection—it’s about preserving your voice and intentions, even when life takes an unexpected tur

Consolidation &

Management of Assets

Unify various asset classes for smoother management during and after your lifetime, through strategic nominations and a properly structured Will.

Skip Probate

Bypass probate for certain assets like CPF and insurance using nominations. Save time, cut costs, and maintain privacy for your family.

Flexibility & Accountability

Enjoy full control of your assets while alive. After activation, a professional trustee ensures your wishes are carried out with continuity and care.

Maintain Assets

Within the Family

Restrict asset distribution to stay within the family tree. You can even suspend distributions in cases like divorce or bankruptcy.

Preserve Family Values

Encourage unity, responsibility, and charitable giving across generations with clear instructions tied to your family’s core values.

Privacy & Asset Protection

Keep your beneficiaries’ identities and entitlements confidential to avoid public scrutiny and minimise family disputes.

Protection of Vulnerable Beneficiaries

Set up structured distributions (e.g., monthly allowances) instead of large lump sums to reduce the risk of exploitation and help beneficiaries manage money wisely.

Build Family Reserves

Use your trust as a family emergency fund—like a “family bank” that supports rainy days, medical crises, or unexpected life events.

Affordable

Standby Trusts are designed to be cost-effective: low initial setup and minimal annual fees until the trust is activated.

Estate Planning is more than just Documents

Let’s build a future that honors what matters most to you.